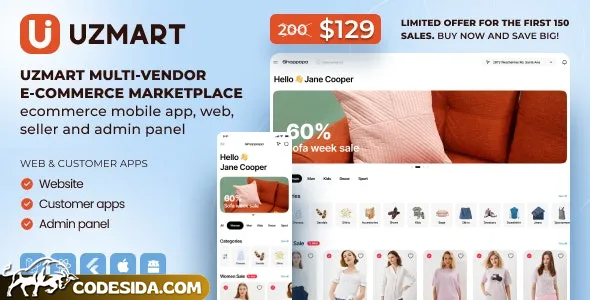

UzMart v1.0 v1.0 - Multi-Vendor E-commerce Marketplace - is a revolutionary eCommerce platform designed to empower vendors and streamline online sales. It offers a comprehensive marketplace where multiple vendors can list their products, manage orders, and process payments, all within a single, unified eCommerce solution.

🔍 Key Features

1. Multi-Vendor Integration

Seamlessly integrates with various vendors, allowing them to list products and manage their inventory.

Buyers have access to a diverse range of products from different sellers in one place.

2. User-Friendly Interface

Intuitive dashboard with easy navigation for both vendors and buyers.

Customizable layouts to suit individual business needs.

3. Real-Time Order Processing

Efficient order management system to track and update order statuses in real-time.

Vendors can manage multiple orders simultaneously with ease.

4. Secure Payment Gateway

Integrated with secure payment gateways for safe and reliable transactions.

Supports multiple payment methods, ensuring a smooth checkout experience.

5. Inventory Management

Automated inventory tracking to prevent overselling and maintain accurate stock levels.

Vendors can easily update inventory status, reducing manual work.

📱 Technology Stack

Leverages Flutter for its mobile app, providing a responsive and native experience across platforms.

PHP and Laravel are utilized for the backend, ensuring scalability and robustness.

The platform also incorporates SQL databases for efficient data storage and retrieval.

🚀 What's New in UzMart v1.0 v1.0

The latest version introduces enhanced security features to protect user data and transactions.

Improved search functionality for a better user experience and easier product discovery.

👥 Ideal For

UzMart v1.0 v1 Written by: John Doe Article Title: "The Ultimate Guide to Understanding the Impact of Inflation on Your Investments" Inflation is a crucial economic concept that affects the purchasing power of money. It represents the rate at which the general level of prices for goods and services is rising, subsequently eroding the value of currency. In this comprehensive guide, we'll delve into how inflation impacts various investment strategies and what investors can do to safeguard their portfolits against its effects **Understanding Inflation** Inflation is measured by the Consumer Price Index (CPI) and the Producer Price Index (PPI). The CPI tracks the changes in the price level of a basket of consumer goods and services, while the PPI measures the average change over time in the selling prices received by domestic producers for their output **The Effects of Inflation on Investments** Inflation can significantly influence investment returns. Here's how 1. **Fixed-Income Investments**: Bonds and fixed-income securities are particularly vulnerable to inflation. As inflation rises, the real return on these investments diminishes since the interest payments remain constant 2. **Stocks**: Over the long term, stocks have historically outpaced inflation. However, during periods of high inflation, certain sectors may be more affected than others. For example, companies with pricing power can pass on increased costs to consumers, thereby maintaining profit margins 3. **Real Estate**: Real estate investments often act as a hedge against inflation. As property values increase, so does the real value of the investment, assuming rental income keeps pace with inflation 4. **Commodities**: Investing in commodities like gold, oil, and agricultural products can be a good strategy during inflationary periods. These assets often see price increases as demand rises with inflation **Strategies to Mitigate Inflation Risk** Investors can adopt several strategies to protect their portfolios from inflation 1. **Diversification**: Spreading investments across different asset classes can help manage inflation risk 2. **TIPS (Treasury Inflation-Protected Securities)**: These are government bonds specifically designed to protect against inflation. The principal amount of TIPS increases with inflation and decreases with deflation 3. **Stocks in Inflation-Resistant Sectors**: Investing in sectors like technology, healthcare, and utilities can provide some level of protection against inflation 4. **Real Estate Investment Trusts (REITs)**: REITs allow investors to gain exposure to real estate, which can be a good hedge against inflation 5. **Commodities and Precious Metals**: Including commodities and precious metals in a portfolio can provide a natural hedge against inflation **Conclusion** Inflation is an inevitable part of the economic cycle, and its impact on investments can be significant. By understanding the various effects of inflation and employing strategic investment approaches, investors can navigate inflationary periods more effectively. Diversification, investing in inflation-resistant assets, and staying informed about economic trends are essential steps in building a resilient investment portfolio